How To Apply For Monetization On YouTube?

For professionals and beginners, YouTube is a popular internet streaming medium. It’s also a great way to make money when you know how to use it. Do you want to become the next big thing on YouTube? Or maybe you’re just interested in finding out how to make some extra money. The people who produce material for YouTube’s different markets, including instructional, entertaining, and inspirational, are known as creators.

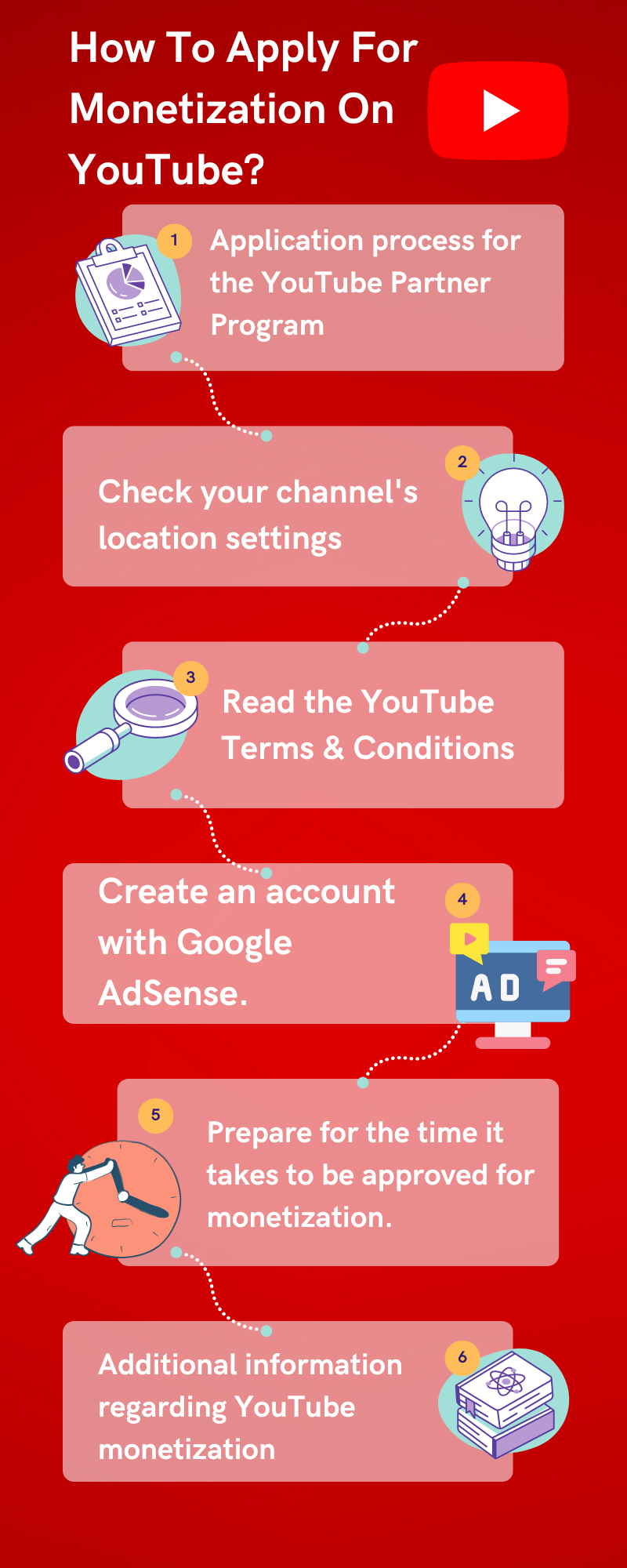

Steps to apply for monetization on YouTube

Apply For YT Monetization

To earn money on YouTube, users must follow some steps necessary to monetize their channel.

1). Application process for the YouTube Partner Program

You must sign up for the YouTube Partner Program to profit from advertising displayed next to your content (YPP). Fortunately, you can do that using your YouTube Studio. To get started, follow the instructions below:

- Click your profile symbol on the YouTube homepage, then choose “YouTube Studio.” from the dropdown menu.

- Click “Monetization” from the left navigation bar.

The monetisation page will track your progress toward 4,000 hours of Watch Time and 1,000 subscribers.

2). Check your channel’s location settings

Checking your channel’s location settings is the first step in the YPP application process. To complete your application quickly, you must ensure your channel is set to the appropriate country. You can modify the nation listed on your channel by using YouTube Studio’s settings menu.

3). Read the YouTube Terms & Conditions.

The next step in the application process is to review the YPP rules. In essence, you are signing a business agreement wherein YouTube and you both have obligations to make the partnership successful.

Get your parents or legal guardian to review the application if you are underage. This is crucial since if you attempt to complete the application alone, you’ll inevitably get stopped later (such as creating an AdSense account).

Next, be aware that the documents YouTube provide contain only some required information. You might accidentally accept the YouTube policies and rules when applying the YPP.

4). Create an account with Google AdSense.

You must set up a Google AdSense account to get payment from YouTube. YouTube

Once you link this account to your channel, you will transfer earned money from your AdSense account to your bank account.

Follow these instructions to set it up:

Select YouTube Studio > Monetization from your profile icon on the YouTube home page to return to the monetization section of the site.

- Go to the YPP application step two, which involves creating a Google AdSense account. Select “Start.”

- You’ll be asked to connect to your Google account for security reasons. You will be prompted to indicate if you currently have an AdSense account. Follow the instructions on the screen if you’re creating a new one.

5). Prepare for the time it takes for monetisation approval.

When will YouTube start reviewing your application, then? The official response, which can be seen on YouTube’s help page, is “approximately one month.” Despite this delay, most creators receive a response far more quickly.

6). Additional information regarding YouTube monetization

The application procedure is relatively easy after you’ve satisfied the prerequisites for YPP.

Before and after your channel is monetized, you should be aware of certain factors, such as:

- YPP may have rejected your channel. However, you are not necessarily “failed” forever. Before you may reapply, you have 30 days to make any necessary adjustments to your channel.

- You will receive 55% of all advertising income from AdSense, with YouTube taking the remaining 45%.

- Super Chats and Channel Memberships have a 70-30 income split. While YouTube keeps 30%, you receive 70%.

- Before YouTube delivers money to your bank account, you must make at least $100, which can take up to 60 days for the money to show up.

- Your revenue is probably taxable even though YouTube doesn’t deduct local taxes. We strongly advise seeking advice from a local tax professional in your area.